If you wish to live-in an area that knowledge all the four season, you are considering the Great River County out-of Michigan. Before you buy a property no matter if, you will need to look for a mortgage. However, don’t simply match the original home loan your already been around the, specifically since the an experienced.

Qualifying Michigan experts and you will active-responsibility service users deserve gurus that will be guaranteed by new Institution from Veterans Activities (VA). Probably one of the most recognized advantages is the possibility to safer a great Michigan Virtual assistant financial. Regardless if you are buying or building another type of domestic, or renovating your existing home, you happen to be entitled to financing that can be used to aid save several thousand dollars on the home loan.

Elements We Suffice

- Detroit

- Ann Arbor

- Grand Rapids

- Lansing

- Troy

- Warren

- Farmington Slopes

- Rochester Hills

- Kalamazoo

We are authorized about whole condition of Michigan, so don’t get worried if not visit your urban area or town about this number. The financing officials makes it possible to find the appropriate mortgage to possess your, even although you do not qualify for a beneficial Michigan Va mortgage.

Michigan Virtual assistant mortgage brokers commonly given by the Service of Seasoned Facts (VA), but they are protected from the Va. Consequently the new Va try guaranteeing the loan for folks who default. To help you safer a Michigan Virtual assistant financing, you need to read a private bank.

The loan techniques is nearly a similar in most states however, may differ with respect to the financial you manage. Go after these measures to begin the mortgage loan recognition process to own a Virtual assistant financing:

Virtual assistant Financing compared to. Old-fashioned Mortgage inside the Michigan

There are lots of celebrated differences between antique and you will Virtual assistant mortgage brokers. For example, Virtual assistant financing require no down-payment, when you find yourself traditional mortgage loans might need up to a 20% advance payment. At the same time, home loan insurance is not required getting good Va mortgage, but it’s generally required for one conventional mortgage where in fact the borrower throws less than 20% off.

Va Financing Pros into the Michigan

Typically, Va funds bring so much more positives getting experts than simply conventional mortgage loans. If you are an experienced otherwise provider representative, you’ll relish advantages of Va money instance:

Virtual assistant Loan Limitations inside Michigan

If mortgage limits still apply at you, their limit is usually determined by in which your new residence is discovered. This type of constraints transform per condition and you will for each and every state. By 2022, the loan limit for everybody counties when you look at the Michigan try $647,two hundred. If you need financing exceeding it number, you’ll end up required to make a downpayment.

Do you know the Official certification to have a good Va Mortgage inside Michigan?

People that can put on getting a good Virtual assistant home loan into the Michigan is effective-duty service participants and you can experts, as well as partners off members shed when you find yourself offering.

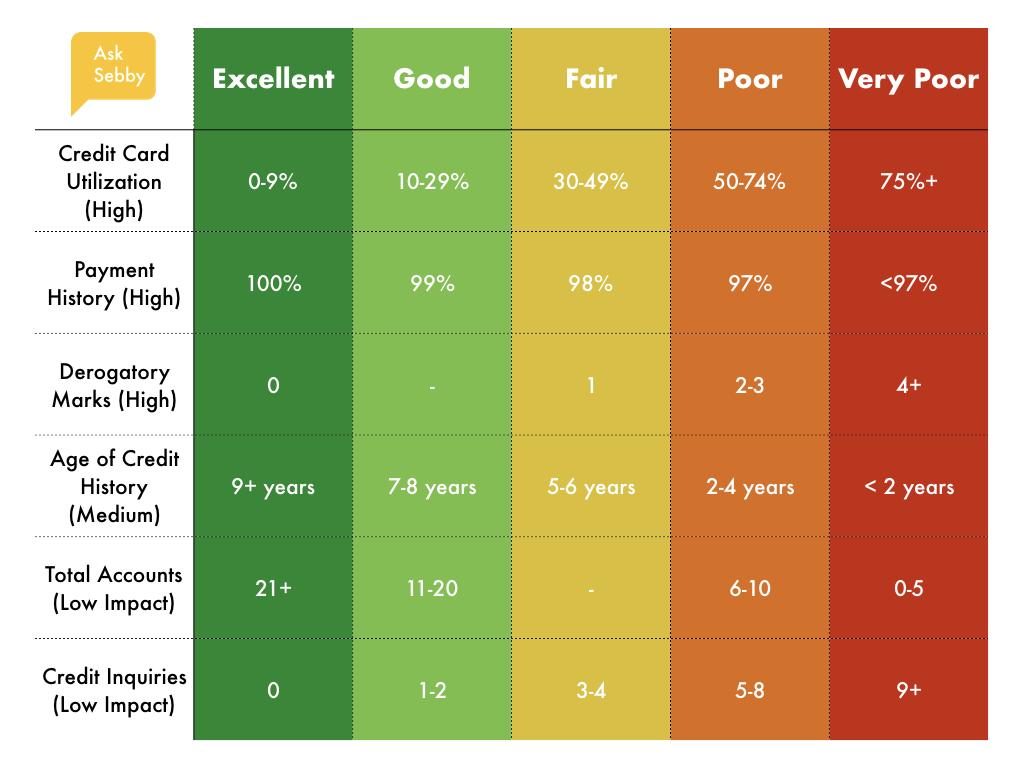

Credit rating

Lenders will look at your credit history no matter what financing you happen to be trying to get as they must make sure that you will be someone who will pay right back expense. The credit get need for good Virtual assistant mortgage is commonly all the way down than simply a traditional loan to include alot more leniency to help you experts. We truly need a minimum credit score from 550 for the Michigan Virtual assistant money.

Money

Your earnings means there is the necessary financing to pay back the borrowed funds month-to-month. To verify your income, your financial look on tax returns and you can spend stubs.

Appraisal by the Va

This new assessment was a way of calculating the value and you may architectural stability of the home to be certain you are not seriously overpaying ahead of they guarantee the financing.

Energetic Responsibility Provider Requisite

Energetic obligation provider professionals need meet up with the minimum energetic responsibility solution criteria as reported by brand new Va. You must have offered for around ninety successive weeks while in the wartime otherwise 181 months throughout the peacetime, or if you must have served half dozen many years from the Federal Guard otherwise Reserves.

Form of Va Mortgage Applications

You can expect different types of Va lenders inside Michigan to complement the unique requires your individuals. They’ve been:

Apply for an excellent Virtual assistant Mortgage inside Michigan

You may want to qualify for a Va financing that can assist conserve you thousands of dollars. We are able to make it easier to safe that loan into the Michigan making the procedure a lot easier meanwhile. From the Griffin Capital, the audience is proud to assist services professionals in gaining its goals away payday loan Shaw Heights from to-be a citizen or protecting on their financial.